A recent survey from Zillow found that prospective homebuyers spend about as much time researching new TVs … and more time researching their next vehicle purchase… than they do mortgage lenders. In fact, 72% of prospective buyers “have not shopped around, nor have any plans to shop around, for a mortgage that best suits their financial situation,” says Zillow.

That’s astounding given that buying a home is probably the most important — and most expensive — purchase most people will ever make.

According to the survey, 46% of prospective buyers who submitted applications for mortgage pre-approval submitted only that single application.

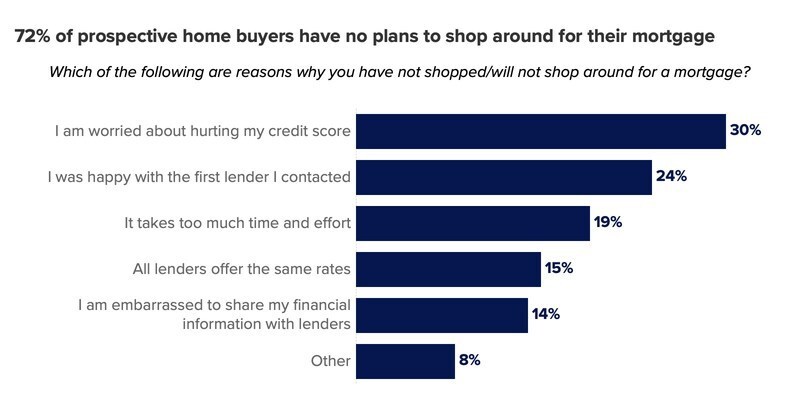

So why are people so reluctant to comparison shop when it comes to mortgages? According to Zillow:

- They don’t want to share their financial details with multiple lenders and they are willing to pay extra rather than shop around.

- They’re “happy with the first lender,” or shopping around just takes too much time and effort.

- They’re fearful that having more lenders check their credit will harm their credit score. (This can happen when lenders do a “hard pull” on your credit.)

- They’re under the impression that all lenders offer the same rates.

Source: Zillow Home Loans

But here’s the bottom line: Homebuyers who don't shop around could spend tens of thousands of extra dollars over the lifetime of their loan. “They are literally leaving money on the table,” says Robert Greenbaum, Chief Sales & Marketing Officer at AMS.

Related: What Every Military Homebuyer Should Know About Credit

Mortgage Shopping 101

With housing prices at their highest level ever in 2022, and mortgage rates at a 20-year high in mid-November 2022, it's important that homebuyers understand their mortgage options and get the best deal they can, he notes.

Here’s what Greenbaum recommends. “First, check your credit score and if it’s under 580, use these tips to raise it before you apply for loans,” he says.

Next, do as much research as possible on lenders before you apply for a loan from any of them — you can probably get referrals from friends, family or your real estate agent.

“Once your credit is in good shape, contact AMS (or any lender) for a pre-approval,” says Greenbaum. Note: a pre-approval does not mean you have to use AMS for your loan and is not a guarantee you’ll be offered a loan.

Then, you’ll want to visit properties that fit your criteria in terms of location, lot size, amenities, etc. When you find the one, you’ll want to work with your real estate agent to make an offer.

Tips for Working with Lenders

Now you’re ready to talk with loan officers (notice the plural there). "Loan officers, like our Military Mortgage Advisors, should become partners in this process to help you make the best decision for your personal financial needs,” says Greenbaum. “Mortgage rates change daily, so you’ll want to try to get them all on the same day so that you’re seeing an accurate comparison, and remember to ask about lender fees and other costs” he adds.

Each lender will look at your credit and ask for verification like payroll stubs or 1099s (if you’re self-employed). You’ll need to fill out a loan application, too. That’s when the hard pull on your credit will happen, so you’ll want to limit the number of pulls (lenders) to three or four, he advises.

Within three business days, you should receive a loan estimate (LE). The LE details a mortgage’s upfront and long-term costs. “It’s vital that you review the LEs thoroughly and carefully evaluate your loan options, as it may save you thousands of dollars,” says Greenbaum.

Related: How to Read Your Home Loan Estimate

How to Compare Loan Estimates

The LEs will have a lot of information you’ll want to know (and luckily they all use the same template by law). The three-page LE includes:

Page 1: Loan details

Page 2: Closing cost details

Page 3: Additional information about the loan

Page 3 of your Loan Estimate is what you’ll use to compare competing offers from different mortgage lenders. It includes:

- How much you will have paid after five years.

- The loan’s Annual Percentage Rate (APR), which is the total cost of the loan including fees, shown as a percentage.

- The total amount of interest you will have paid over the duration of the loan term, or Total Interest Percentage (TIP).

- Other considerations such as appraisal, homeowners insurance, late payments, etc.

Two other important parts of your LE you should review when comparing offers are: 1) whether or not the interest rate is locked (page 1); and 2) application and underwriting fees (page 2, Loan Costs Section A).

“The Annual Percentage Rate and Total Interest Percentage are two items you should compare carefully — some lenders build in fees and you’ll want to be sure you’re not overpaying for your loan,” Greenbaum advises.

If you have questions, you should ask the lender. They should be able to explain the loan to you in terms you understand. (If they don't, maybe that’s not the right lender for you.)

“Once you’ve compared terms be sure to let the lender you prefer know,” Greenbaum says. The terms on your Loan Estimate are binding for 10 days from the day you receive the document. Terms can be changed, however, if there are major changes with the loan or your application.

We’re Here to Help

Whether you’re just thinking about buying, ready to start home-shopping in earnest, or considering a refinance, an AMS Military Mortgage Advisor will be happy to provide you with an honest and fair comparison of your mortgage options, including a wide range of affordable mortgages designed to meet your needs.

Ensuring AAFMAA Members obtain the best mortgage possible is our mission. Get your free mortgage assessment today or give us a call at 844-422-3622.

.png)

.webp)