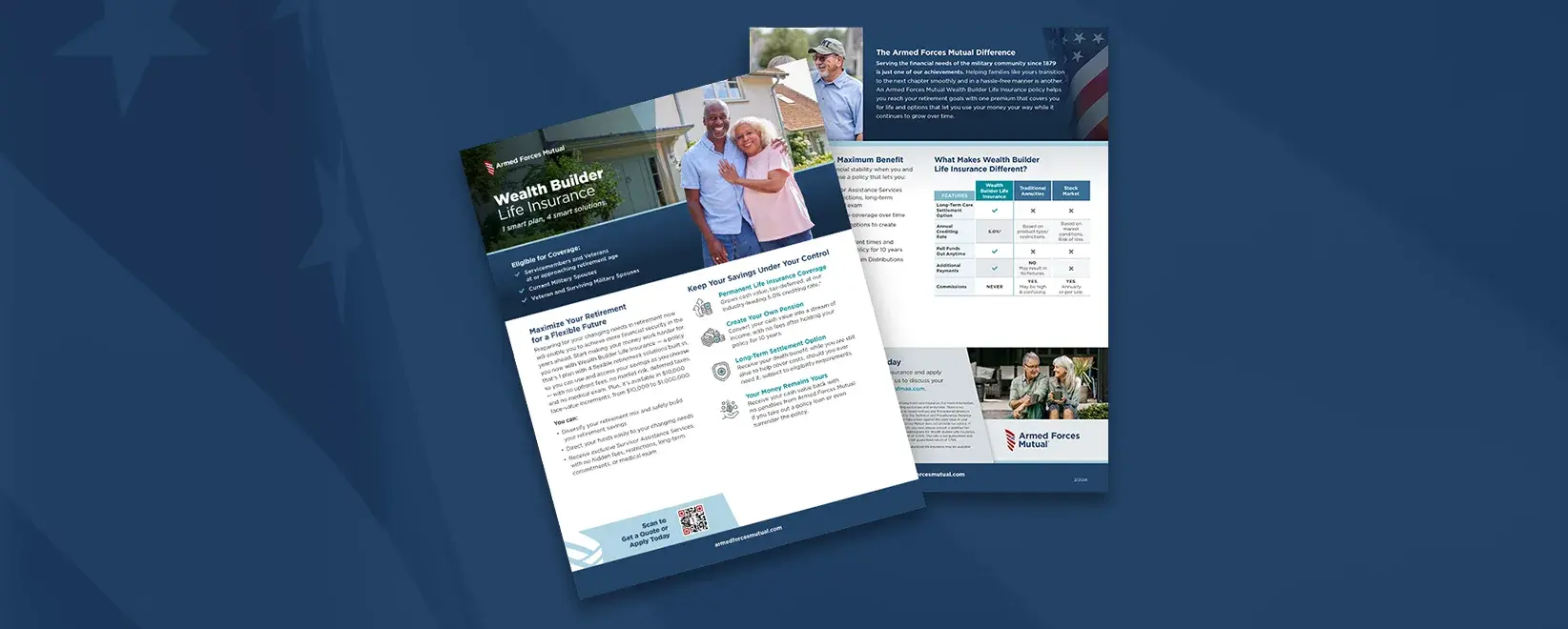

Wealth Builder Life Insurance

Make your retirement savings work harder with our industry-leading 5.0% crediting rate* while creating flexible options for your future — all with no upfront fees, no market risk, deferred taxes, and no medical exam. Policies are available in $10,000 face value increments from $10,000 to $1 million.

1 Plan, 4 Retirement Solutions

Wealth Builder Life Insurance gives you complete control over your retirement savings with multiple built-in options.

Your Savings, Your Control

Wealth Builder Life Insurance transforms your retirement savings into a versatile financial tool that can satisfy your changing needs in retirement.

Wealth Builder Life Insurance is designed for members of the military community, their spouses and widows/widowers, typically over age 55, who want to maximize their retirement savings while creating flexible options for the future.

Growth & Security

Income Options

Long-Term Care Settlement Option

Using Your Savings

Who Can Apply?

Wealth Builder Life Insurance is designed for members of the military community, their spouses and widows/widowers, typically over age 55, who want to maximize their retirement savings while creating flexible options for the future.

Retirement Success Stories

Hear from fellow Veterans who have secured their retirement with help from Armed Forces Mutual.

Ameer M., Member

Doug L., Member

Larry O., Member

Want to Know More?

Can I access the money in my Wealth Builder Life Insurance policy if needed?

Yes. You may access your Wealth Builder Life Insurance cash value any time by taking out a policy loan, annuitizing the cash value, or surrendering your policy.

If you choose to surrender your policy, you will receive all of your money back, including the premium paid and any interest earned. If you receive the funds before you are age 59-½, you may have to pay a 10% tax penalty on the interest earned to the IRS.

Alternatively, after holding your Wealth Builder Life Insurance policy for 10 years, you may convert it into a lifetime annuity payment. Additionally, at any time you may take a policy loan of up to 75% of the cash value in the policy.

What are the tax advantages?

Wealth Builder offers multiple tax advantages: cash value grows tax-deferred, death benefits are generally income tax-free to beneficiaries, and policy loans can provide tax-advantaged access to your money during retirement.

What are the potential tax implications of accessing my Wealth Builder Life Insurance cash value?

All Wealth Builder Life Insurance policies are Modified Endowment Contracts (MECs) and subject to TAMRA. You may own any number of Wealth Builder Life Insurance policies, in increments of at least $10,000 each, up to a total combined face value of $1 million.

If you decide to cash surrender one or more Wealth Builder Life Insurance policies purchased during the same calendar year, you will pay taxes on the interest earned for all of the policies you own — even those you do not surrender, which remain in force. When you cash surrender subsequent policies, since you have already paid some or all of the taxes, you will pay less tax on the gain for those policies.

Ultimately, the amount of total taxes on the policies surrendered will be roughly the same because the tax basis of the subsequent policies will be increased to reflect the taxes already paid. This will not have an impact on policies that are annuitized, if all policies are surrendered simultaneously, or in the event of the policy owner’s death.

What is guaranteed about my Wealth Builder Life Insurance policy?

Your Wealth Builder Life Insurance policy is guaranteed to earn a minimum crediting rate (specified in your policy) less administrative charges for mortality and expenses. The graded death benefit only applies to policies issued to Members ages 78 and higher and will pay 90% of the initial death benefit in year one, 95% in year two, and 100% in year three, and thereafter.

How much does Wealth Builder Life Insurance cost?

To buy a Wealth Builder Life Insurance Policy, you pay a one-time, net single premium of $750 per $1,000 of death benefit. Policies can range from $10,000-1,000,000 of coverage.

Retirement Planning

Valuable resources to help you maximize your retirement savings and create financial security.

Denotes content only available to subscribers

You work hard throughout your earning years to save for a secure retirement—one in which you can enjoy your family, ...

Explore why Armed Forces Mutual's Wealth Builder Life Insurance may be a better option than QLACs for military retirees ...

Build retirement income and lifelong protection with Wealth Builder Life Insurance from Armed Forces Mutual. Earn ...

Denotes content only available to subscribers

Armed Forces Mutual Wealth Builder Life Insurance is a life insurance policy. This is not long-term care insurance.

Subject to the terms and conditions of the policy, including exclusions and limitations. There is no insurance coverage unless you apply and are accepted by Armed Forces Mutual, a policy is issued, and you pay the required premium. No war, aviation, or terrorist clause. All policies include Survivor Assistance Services.

*Armed Forces Mutual's crediting rate for Wealth Builder Life Insurance is currently 5.0% for 2026, minus an administrative cost, currently 0.75% for a net current return of 4.25%. This rate is not guaranteed and is subject to change. The guaranteed crediting rate is 2.5%, minus the administrative fee for a net guaranteed return of 1.75%.

Wealth Builder Life Insurance policies are Modified Endowment Contracts (MECs) subject to the Technical and Miscellaneous Revenue Act of 1988 (TAMRA). Under TAMRA, you may owe taxes and penalties if you surrender or take a loan against the cash value in your Wealth Builder Life Insurance policy. Please read important tax information here. Armed Forces Mutual does not provide tax advice. If you have questions about the tax implications of this product or other life insurance products you own, please consult a qualified tax professional.

The U.S. Government does not sanction, recommend or encourage the sale of this product. Subsidized life insurance may be available from the Federal Government.