Sure, budgeting is a topic no one really wants to talk about, but let’s do it anyway! Start each new year with a clear plan for tackling your debt, improving your savings, or just getting financially organized.

Ever Heard of the 50/30/20 Rule?

It goes like this:

- 50% for needs, such as a house, car or food

- 30% for wants, such as entertainment and travel

- 20% for saving, such as debt repayment and retirement savings

Now let’s break down these three buckets a little more:

In your 50% bucket, remember this: Your housing should cost no more than 28% of your gross income (principle + Interest + taxes + insurance) divided by gross income.

Also keep in mind the 36% rule: It is recommended that your Total Debt Load should exceed 36% of your income. You can learn more about this figure here.

Emergency Funds — Yes, You Need Some

Be sure to keep enough funds to cover 3-6 months’ worth of expenses to ensure you will be able to maintain your current lifestyle for 3-6 months, if you are not working and earning an income during that time.

For a number of Veterans, housing, health insurance and food are covered at zero cost to them. For the others who don’t receive this coverage, it can be a big shock when the decision to leave the service comes and they discover they must pay these products and services themselves. So while you’re still on active duty, be sure to SAVE what you would normally be spending on food, health insurance or housing. That way, it will be there in the future.

If you are leaving the service, make sure you get a realistic idea of what your housing, food, and health insurance costs will be so you can budget appropriately for them monthly.

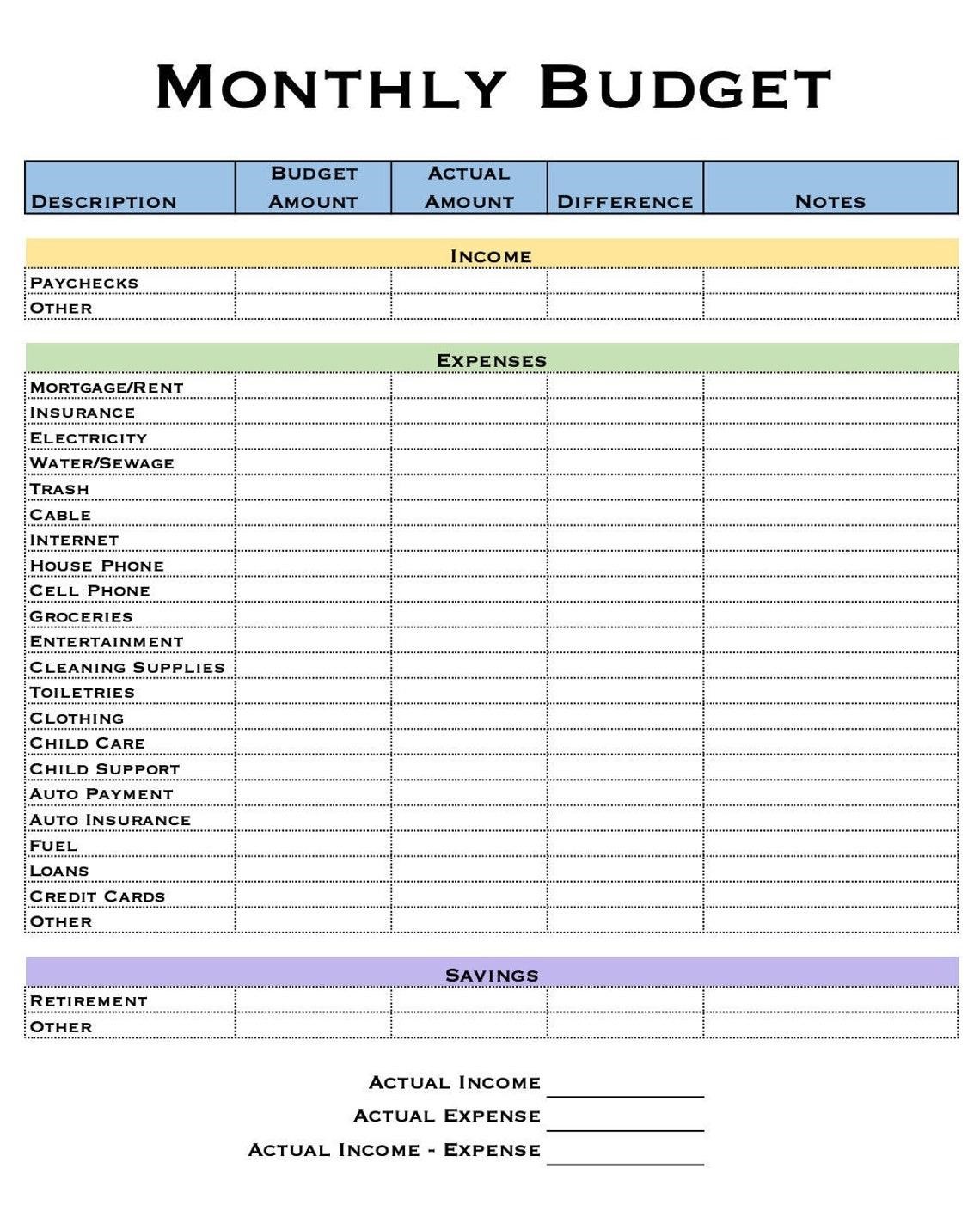

Below is a simple budget plan to get you started. You can use this to fill in your personal expenses. But setting a budget is only the first step. It takes discipline and hard work to stick to it — something Veterans know very well. So once you’ve made your budget, be sure to stick to it so you can reap the financial rewards that come with it one day! This is just one step in your foundation to financial success.