If you’ve been wringing your hands over the stock market these past few months, you’ll be happy to see it rebounded a bit in May. This upward movement came despite the continued noise around tariffs, global growth and political activity. Corporate earnings for the first quarter were better than expected, for the most part. Forward-looking guidance for the remainder of the year has been in line with analyst expectations (with some exceptions), as companies are showing increased visibility and confidence in the business landscape. The small cap market has quietly outperformed larger companies this year, in part due to tax cuts and economic strength.

With some uncertainties gradually being removed, U.S. equity indices moved ahead in May, while trade and currency worries continued to weigh on international markets. Our belief that the equity market will record positive returns for the year and better reflect the earnings that are being generated still holds strong

Meanwhile, the bond market appears to have stabilized for the time being. Still, we’re shortening maturities/duration in the fixed income portion of portfolios to account for any insecurity. We believe sustained economic growth will cause interest rates to rise over the next 12 to 18 months. With S/T rates already discounting Fed increases, our prediction of a flatter yield curve has proven correct.

With only a 45 basis point difference in yield from the 2 year to the 10 year U.S. Treasury, the risk/reward profile for bonds clearly favors the short end of the yield curve. We have reduced our current bond weighting in the 2 to 5 year maturity range and our duration range is now less than two years. Corporate debt is still favored over Treasury debt in taxable portfolios, with floating rate securities providing a hedge against moderate interest rate increases.

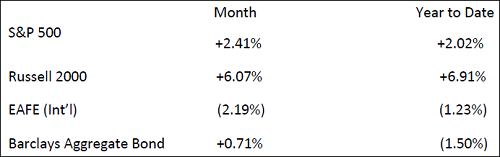

Market performance through 5/31/2018:

Curious about what these changes mean for you? Connect with your AAFMAA Wealth Management & Trust Relationship Manager to find out how they affect your investment positioning. While markets are in this range, take the time to meet with your RM to review your risk profile and any life change impacts that may be occurring. You’ll be glad you scheduled the appointment.

Disclosure: Information provided by AAFMAA Wealth Management & Trust LLC is not intended to be tax or legal advice. Nothing contained in this communication should be interpreted as such. We encourage you to seek guidance from your tax or legal advisor.