Building a robust employee benefits package is key to attracting top talent and boosting retention in a competitive market. Providing group term life insurance to your employees is one of the many popular ways you can improve your benefit offerings and show how much you care for them.

Whether you currently offer group term coverage to your employees, just added this great benefit, or are looking to do so, here are 4 need-to-know tips about group term life insurance.

1. What is group term life insurance?

Group term life insurance is a policy that covers a group of "active at work" employees, otherwise known as full-time employees, within your organization. It’s one of the many parts of an employee benefits package. Group term life insurance pays out benefits to an employee’s beneficiary should they die while the policy is in force — usually based on continued employment.

1) $50,000 or less is tax exempt.

If you are providing $50,000 or less in life insurance, this is a nontaxable fringe benefit. You do not have to report it on the employee’s W-2. There are no tax consequences.

2) More than $50,000 in group term? Here’s how taxable premiums are calculated:

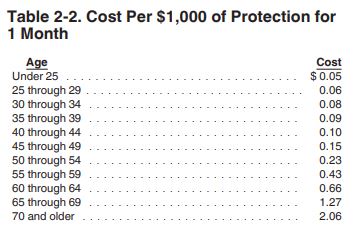

If the life insurance coverage you've selected is more than $50,000, the excess amount is considered a non-cash fringe benefit and it is taxable to the employee, see page 14-15 of IRS Publication 15-B. The excess amount over $50,000 is taxable and the total amount per employee will be reported within each employee's W-2 based on additional cost per $1,000 by month and within their respective age bracket.

2. How do you calculate taxable cost?

Table source: 2022 Publication 15-B (irs.gov)

Example: An employer provides one of its employees with group term life insurance coverage of $100,000. The non-taxable portion is the first $50,000, the taxable portion is the remaining $50,000, so the one-month calculation is 50 times the cost shown in the table based on the employee's age bracket. Then you multiply that result by the number of months in the calendar year to get the wages you should report in boxes 1, 3, 5, and 12 (with code “C”) of the employee’s Form W-2. In our example, the employee is 42 years old and they were covered for a full 12 calendar months. So, the yearly tax cost of the excess $50,000 of coverage for this employee is $60 ($.10 x 50 x 12 = $60).

If this was a new employee starting coverage on 1 April 2022, for example, it would be nine calendar months of tax.

3. How is group term life insurance calculated?

Group term life insurance policies are normally less expensive than individual policies and, again, they come with the benefit of no medical underwriting within benefit limits of the plan. The premium is either employer- or employee-paid. Premiums for younger employees are usually less costly than those for older employees, and the costs for companies with higher-risk occupations may be higher (first responders vs. office workers).

4. Is group term life insurance enough to meet my employees’ needs?

There are two things to consider:

- The benefit is often lower than if your employees purchased individual life insurance policies on their own.

- The benefit is tied to their employment, so if they stop working for your company, their coverage will stop. Some companies may offer a conversion benefit that allows employees to switch to a permanent plan.

Organizations Serving the Military Community Can Cover Their Employees with AAFMAA Group Term Life Insurance

If your company mission supports military families and Veterans, you may qualify for exclusive access to affordable Group Term Life Insurance from AAFMAA. With this extraordinary employee benefit, you can provide each of your team members with up to $300,000 of coverage. Not to mention, none of your employees will be required to submit to a medical exam or answer any questions about their health! This is a major benefit to all, especially those who may have health concerns or who may be unable to qualify for underwritten life insurance elsewhere.

At AAFMAA, Membership Means More

In addition to the benefit of no medical requirements, by selecting AAFMAA Group Term Life Insurance, you are connecting your employees to our historic Association, which has been trusted by military families since 1879. While their AAFMAA Group Term policy is in force, they have the exceptional benefit of access to all of our products and services, which is traditionally restricted to current and former servicemembers only. That includes our exclusive Survivor Assistant Services where, should the Member pass away, their survivors are personally taken care of by a professional with expertise in handling survivor benefits.

Together we can bring financial confidence to the families that support your mission.

Learn more about AAFMAA Group Term Life Insurance by emailing [email protected].